Weekly Musings – March 17th 2021

Best Tweet

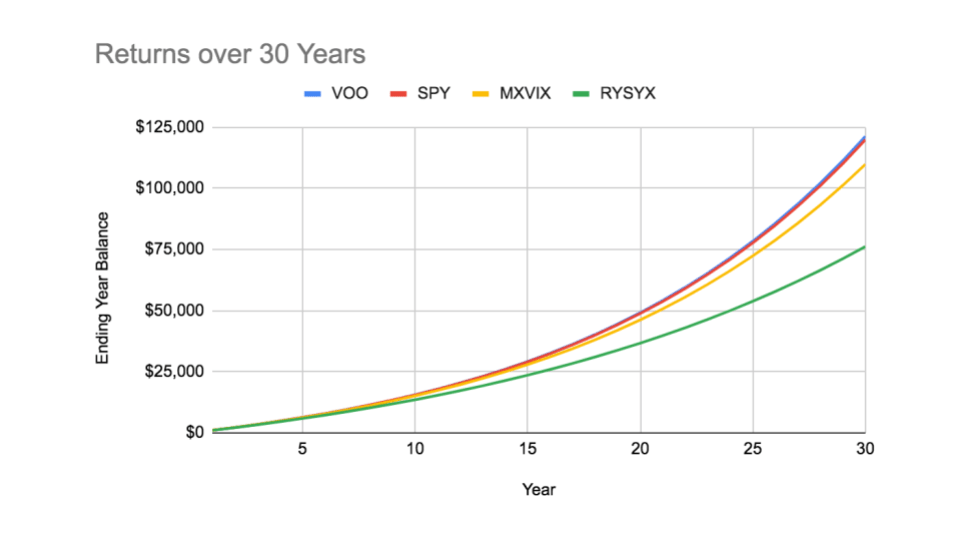

Patrick brings the heat on how to save. Remember, taxes and fees are guaranteed, gains are not.

Best Podcast

Lex Fridman talks with the founder of Algorand and MIT Professor Silvio Micali

They talk about:

- What is money and the importance of social constructs

- What is cryptocurrency and why it is important

- The trilemma of Scalability, Security, and Decentralization

- Why Alogrand is important and how it addresses the trilemma

- What Bitcoin and Ethereum got right, and where they fall short

- Life, love and the meaning of it all

Best Article

…The world is a) substantially overweighted in bonds (and other financial assets, especially US bonds) at the same time that b) governments (especially the US) are producing enormous amounts more debt and bonds and other debt assets.

-Ray Dalio

Because I believe that we are in the late stage of this Big Debt Cycle that mechanistically works in the way I described, I believe cash is and will continue to be trash (i.e., have returns that are significantly negative relative to inflation) so it pays to a) borrow cash rather than to hold it as an asset and b) buy higher-returning, non-debt investment assets.

-Ray Dalio

Wild Card

Backtest Dollar Cost Averaging into Bitcoin over different time periods