A 30 Year Mortgage is a Gift

If you thought taking out a 15 year mortgage was going to save you money you were SCAMMED!

What if I told you for the same amount of money per month you could have:

- More Flexibility

- More Security

- More Money

Example:

You and your loved ones find a house you LOVE! You need a $200K mortgage to buy the home.

You get the mortgage rate quotes below:

- 15 Year: 2.50%

- 30 Year: 3.00%

The 15 year loan SEEMS cheaper, but there is a cost you don’t see! What is it?

For every dollar that you pay into the mortgage you MISS the chance to invest it. This is called Opportunity Cost

So how does this play out?

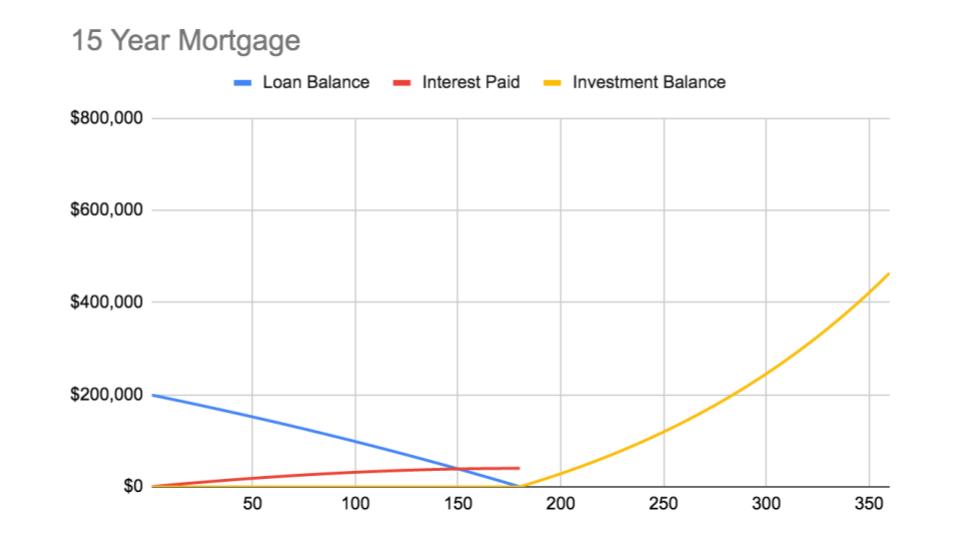

15 Year Mortgage

- Rate: 2.50%

- Payment: $1,333

- Total Interest Paid: $40,622

After you fully pay off the mortgage you invest the payment of $1,333 every month for the next 15 years at an 8% return.

- Investment Balance: $464,344

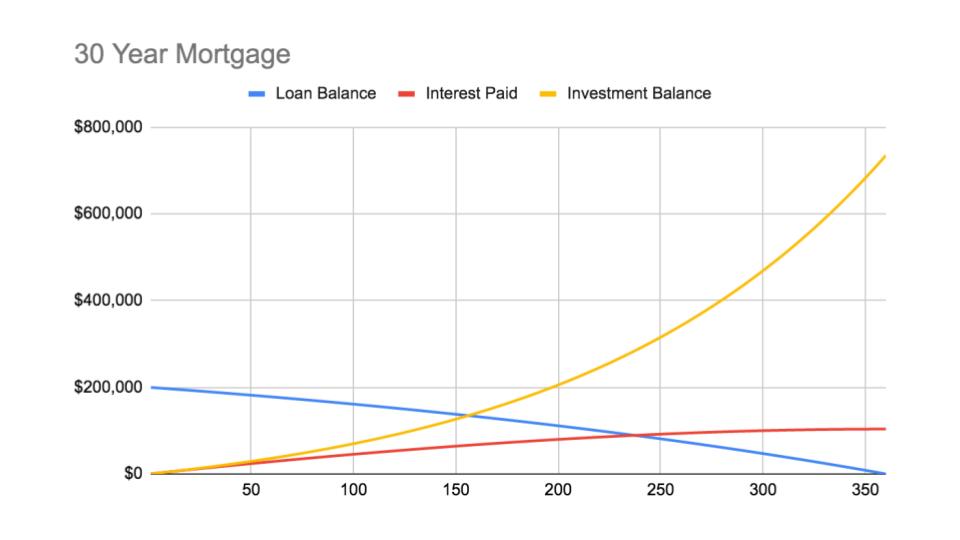

30 Year Mortgage

- Rate: 3.00%

- Payment: $843

- Interest Paid: $103,601

You invest the difference of $490 between the 15 year and 30 year mortgage payment every month for 30 years at an 8% return.

- Investment Balance: $735,145

Choosing the 30 year mortgage you pay $63,535 in extra interest ($103,601 – $40,066) But gain $270,801 in investments! ($735,145 – $464,344)

A net of $207,265!

The Opportunity Cost of choosing the 15 year mortgage is $207K!

But that is not it!

You gain Flexibility AND Security! If life happens and you:

- Lose your job

- Have a decrease in income

- Become disabled

You will have

- A payment that is lower by $490/month or $5,880/year

- Reserves in investments to help pay for it!

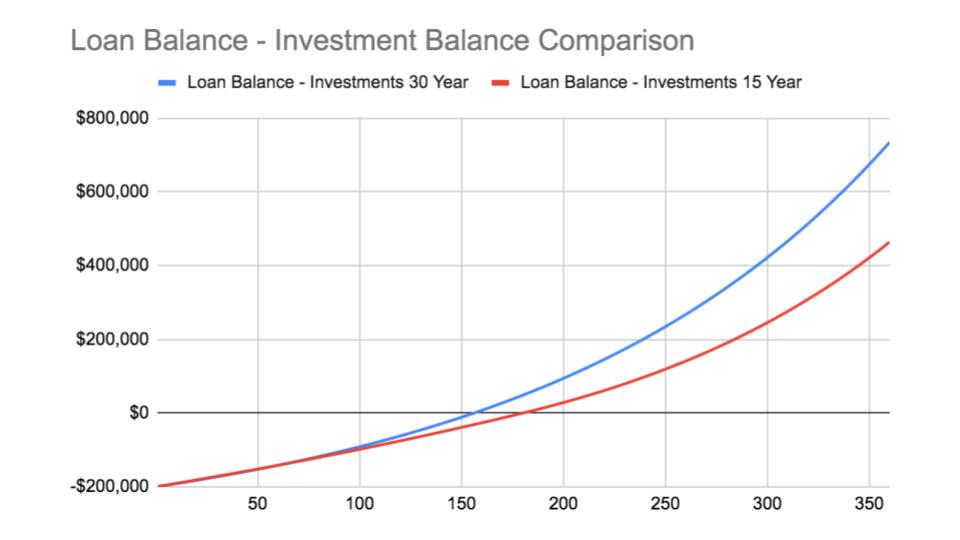

- When you compare the Loan Balance – Investment Balance they are almost the same for 5-6 years, but the compound interest in the investment balance for the 30 year mortgage really takes off

Just so you know I practice what I preach I just refinanced from a 15 year to a 30 year at 2.625%.

Why?

- I only pay $1,200 more a year in interest

- With tax breaks that $1,200 is more like $936

- The amount I am saving is being invested