The Silent Killer of Investment Returns – The Impact of Fees

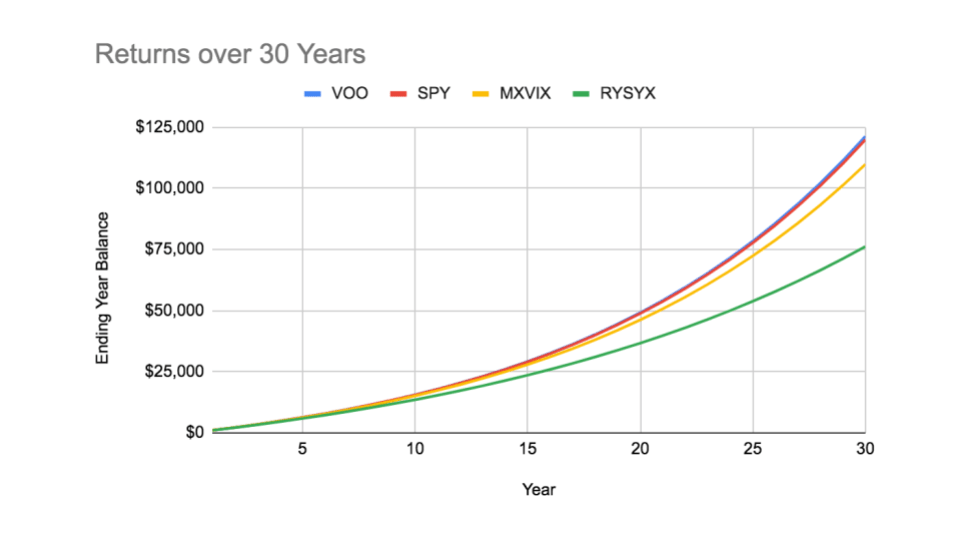

Did you know fees compound in your investments just like your investment returns? Let’s looks at some funds that track the S&P 500 and the impact of fees.

- VOO – 0.04%

- SPY – 0.01%

- MXVIX – 0.52%

- RYSYX – 2.33%

So what impact does this make? Lets work through an example.

Assumptions:

- $1,000 invested every year

- Investment Timeline is 30 years

- Investment return is 8% annually the same across all funds

Vanguard S&P 500 ETF

- Ticker: VOO

- Manager: Vanguard

- Website

- Expense Ratio: 0.04%

- Return in 30 years at 8%: $121,381

- Cumulative Impact of Fees: $554

- Cumulative Impact of Fees %: 0.45%

SPDR® S&P 500® ETF Trust

- Ticker: SPY

- Manager: State Street Global Advisors

- Website

- Return in 30 years at 8%: $119,953

- Annual Fee: 0.01%

- Cumulative Impact of Fees: $1,225

- Cumulative Impact of Fees %: 1.00%

Great-West S&P 500® Index Fund

- Ticker: MXVIX

- Manager: Great-West Funds

- Website

- Return in 30 years at 8%: $109,855

- Annual Fee: 0.52%

- Cumulative Impact of Fees: $6,491

- Cumulative Impact of Fees %: 5.31%

Rydex S&P 500 Fund

- Ticker: RYSYX

- Manager: Rydex Series Funds

- Website

- Return in 30 years at 8%: $76,190

- Annual Fee: 2.33%

- Cumulative Impact of Fees: $25,445

- Cumulative Impact of Fees %: 20.80%

Just by making a smart choice you can net THOUSANDS of dollars! This is true of any fees associated with your investments, be watchful! Some 401(k), 403(b) or asset under management can be very high!